About Ted Kleinman, CPA

At US Tax Help, I’m not here for the IRS or for the government of any country: I’m here for my clients. I’m a Certified Public Accountant with 30 years diversified business experience operating as your Certified Public Accountant with a specialty in international taxation preparation and planning. I will personally handle all your tax preparation needs and be available to address your concerns and questions in a timely, expert manner.

My clients benefit from my public accounting experience which includes auditing, tax planning and preparation, and management advisory services in diversified industries from real estate development and construction to manufacturing, service, and professional corporations.

Confidential & Secure

I’m a Certified Public Accountant with 30 years diversified business experience operating as your Certified Public Accountant with a specialty in international taxation preparation and planning. After living in Saudi Arabia, Korea, and Japan, Ted became aware first-hand of the challenges that complying with U.S. tax law can present when living abroad. Now that Ted has returned to Oregon, he devotes his practice providing tax services to expatriates in those countries and around the world.

Our CPAs Focus on U.S. Tax Issues for Overseas Clients

We are committed to helping you stay compliant, minimize your tax burden and potential IRS penalties.

Learn How

Streamlined Foreign Account Reporting

Can Help You

How We Can Help You

What Our Clients Say

Learn How

Unpaid Tax Amnesty Programs

Can Help You

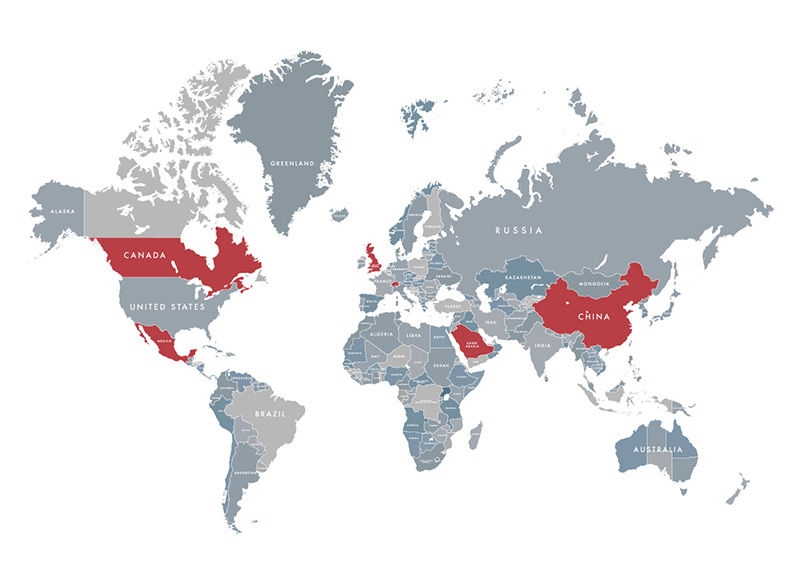

Where Does the IRS Target Expats?

The United States vigorously pursues taxes worldwide and a common mistake many Expats make is assuming their US tax obligations disappear once they move overseas. In fact the US maintains tax treaties with over 66 countries which exchange tax information with the IRS. The US spends over 5 billion dollars a year in the auditing, discovery, collections and prosecution of US citizens living or working abroad. All of this work yields more than 55 billion dollars in additional tax revenue for the IRS.

With the help of an experienced CPA you can lower your tax, minimize or eliminate certain interest and penalties, and avoid tax liens and levies by acting now. Don’t wait! The IRS dedicates significant resources to collect taxes in the following countries. A full list can be found here.